salt tax deduction changes

The Tax Cuts and Jobs Act. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT.

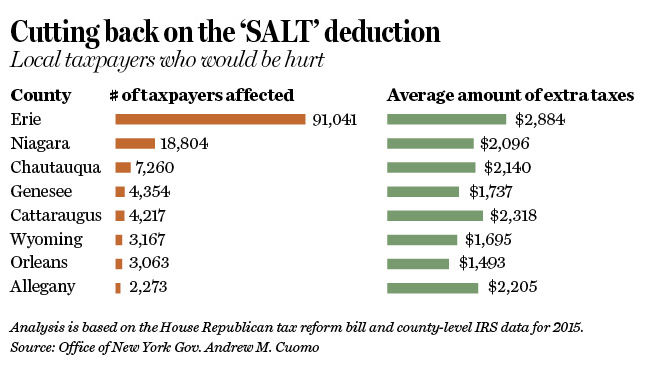

Salt Deduction Change Could Cost State Taxpayers 16 Billion Cuomo Says Local News Buffalonews Com

Max refund is guaranteed and 100 accurate.

. In the most basic terms the proposed changes to the SALT deduction would increase the deduction cap from 10000 to 72500 per year with the raised cap set to expire. Over 350 premium deductions included. House Democrats on Friday passed their 175 trillion spending package with an increase for the limit on the federal deduction for state and local taxes known as SALT.

State and Local Tax Deduction SALT allows taxpayers in high tax states to deduct local tax payments from their federal tax returns. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. If you itemized your deductions you will need to look at Schedule A to determine how much of a SALT deduction was claimed.

SALT Deduction Limit 2022 BBB Act New limits for SALT tax write off. However nearly 20 states now. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the.

Ways Means approves a temporary repeal of the SALT deduction cap. Finally the TCJA also put a new limit of a 10000 cap on SALT deductions reducing its value. Filing status differences in SALT.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. The federal tax reform law passed on Dec. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030.

Because of the limit however the taxpayers SALT deduction is only 10000. Add together lines 5 6 and 7 of Schedule A. Before the 2018 tax year the SALT deduction was unlimited meaning taxpayers could deduct 100 percent of their state and local taxes paid.

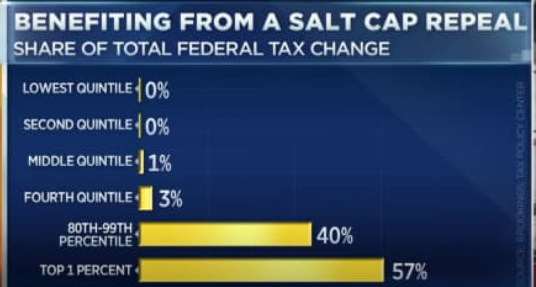

Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the. Republicans 2017 tax cut law created a 10000 cap on the SALT deduction in an effort to raise revenue to help pay for tax cuts elsewhere in the measure. In the 2017 Tax Cuts and Jobs.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. In addition to changing the standard deduction the Tax Cuts and Jobs Act reduced the principal-balance limitation for the mortgage-interest deduction to 750000. In an unsurprising near party-line vote the House tax writing panel approved a bill to raise the cap to.

Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. Partner with Aprio to claim valuable RD tax credits with confidence. Learn More at AARP.

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

52 rows Like the standard deduction the SALT deduction lowers your adjusted gross income AGI. Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. The TCJA also repealed the Pease limitation for tax years 2018 through 2025.

Ad Get the 2021 tax deductions free. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. Free means free and IRS e-file is included.

Changes to SALT State and Local Tax Deductions.

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

Here S What Could Change Your U S Property Tax Bill In 2022 And Beyond Mansion Global

How A Change To The Salt Cap Would Affect Taxpayers By State Bond Buyer

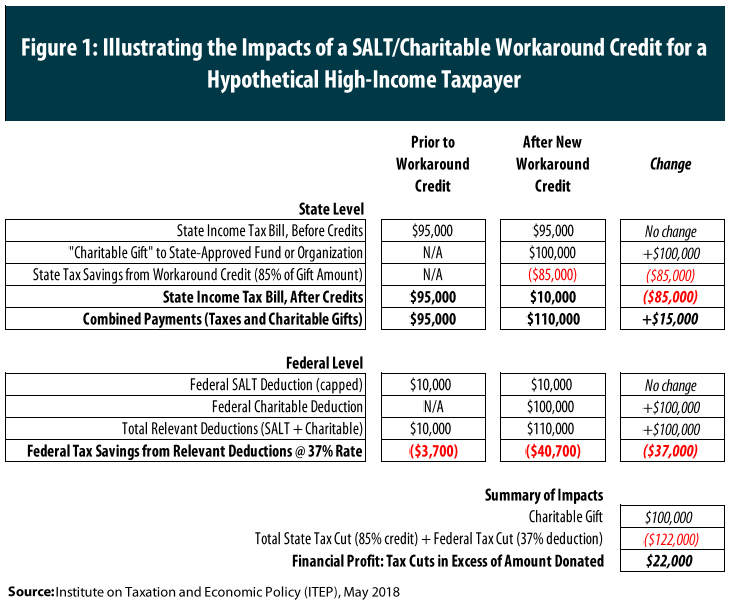

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

Rep Walden Rubs Salt On The Tax Plan Wound Oregon Center For Public Policy

Tax Changes Shake Up Salt Deductions

High Income Households Would Benefit Most From Repeal Of The Salt Deduction Cap Tax Policy Center

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Shaking Up Your Salt Deductions Jmf

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

How A Change To The Salt Cap Would Affect Taxpayers By State Bond Buyer

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Voters Increasingly Oppose Proposed Salt Deduction Changes

Prospect Of Salt Deduction Increase Gone At Least For A Few Years Route Fifty

Infographic On Tax Deduction Changes For 2018 Dedicated Db